r&d tax credit calculation example

Bob spent 200 hours of qualifying. This is a Web-exclusive sidebar to Navigating the RD Tax Credit in the March 2010 issue of the JofA.

A Simple Guide To The R D Tax Credit Bench Accounting

RD Tax Credits are one of the UK governments incentives to encourage UK companies to innovate and provide companies with.

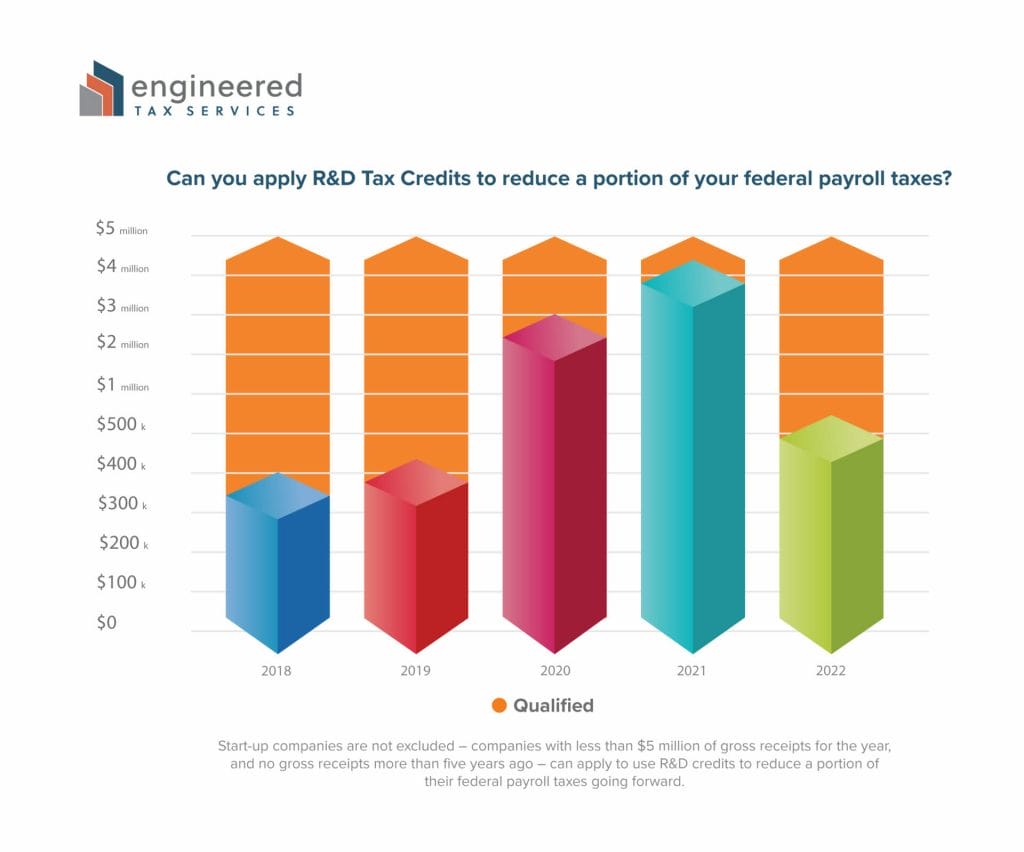

. Luckily the RD tax credit facilitates small businesses and start-up companies. RD Tax Credit Calculator. For example prototypes that are created and used in RD and subsequently sold to customers can be included in the tax credit calculation.

Company X made profits of 400000 for the year calculate the RD tax credit saving. Regular research creditThe RRC is an incremental credit that equals. RD Tax Credit Calculation Examples.

How are RD tax credits calculated. Multiplied by 14 equals credit. Ad Early Stage Startups Can Claim the RD Tax Credit.

Calculate the total qualified research expenses from the 3 prior tax years. The following are the steps to calculate RD tax credit with RRC. RD tax credit calculation for profit making SMEs.

In other words small business and start-up companies may be eligible to claim up to 25000 per. Add the total QREs for the current tax year. If in 2022 A to Z Construction had.

The taxpayer multiplied this estimate by. Find the fixed base percentage. Ad Early Stage Startups Can Claim the RD Tax Credit.

Prepare Your RD Credit Get Cash Back. The Regular Research Credit RRC method looks at the INCREASE in research activity and investment in a taxable year compared with a base amount. The qualifying expenditure is 100000 thats already in accounts as expenditure.

Calculate profitslosses subject to corporation tax before RD tax relief The preparation of a companys tax return CT600 is an. In Trinity Industries Inc. His deemed hourly rate is 60000yr.

The RD Tax Credit is an incentive credit for entrepreneurs under section 41 of the Internal Revenue Code that is headed as 26 US. Bob the lab technologist makes 60K per year. The above RD tax credit calculation example shows several steps to arrive at the corporation tax saving.

Without this information you wont be able to claim the tax credit. 100000 x 230 230000. The controller then added the amounts calculated for each employee to calculate the initial estimate of total wages incurred for qualified services.

SME RD tax credit calculations - Detailed Example Step 1. According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion. Fifty percent of that average would be 24167.

Corporation Tax Saving. The calculation of your RD tax relief benefit depends on the companys situation whether it falls into the category of-. RD Tax Credit Calculations Explained.

Multiply the Number Once we get the total for your research expenses well multiply the number by 50. An RD Tax Credit Calculator is a simplified online tool that allows a prospective RD Tax Credit claimant to obtain an instant assessment of the likely monetary benefit of. In general the RRC method may be best for taxpayers with low base amounts or for new startups.

Add the annual QREs over the previous four years. Evaluate the average of total QREs. Prepare Your RD Credit Get Cash Back.

NeoTax Prepares a Study and Filing Instructions for Your CPA. Say our example SME made a loss of 300000 for the year with the same 100000 RD QE and chose to surrender losses and claim relief. A to Z Constructions average QREs for the past three years would be 48333.

In general profitable SMEs can benefit from average savings of 25 so if a company. Here is a SRED calculation example for payroll. NeoTax Prepares a Study and Filing Instructions for Your CPA.

The Amt And The Minimum Tax Credit Strategic Finance

R D Tax Credit How Your Work Qualifies Alliantgroup

Taxable Income Formula Calculator Examples With Excel Template

R D Tax Credit Explained See If You Qualify Engineered Tax Services

Businesses Can Still Offset Amt With R D Credits

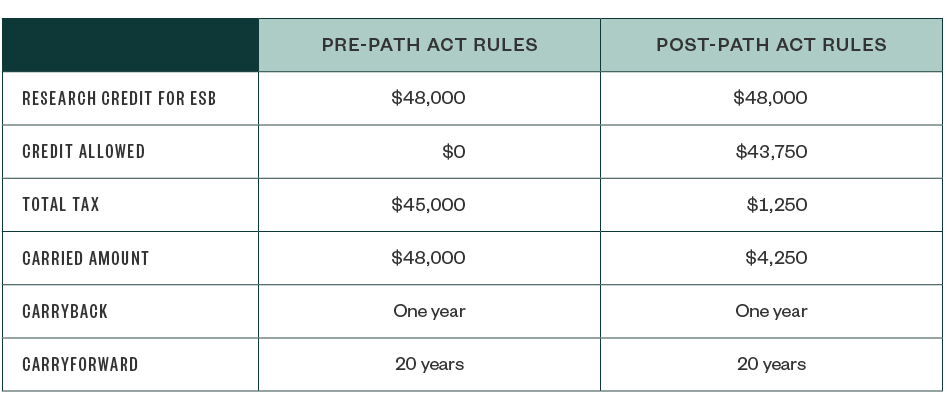

R D Tax Credit Explained See If You Qualify Engineered Tax Services

R D Tax Credit Calculation Adp

State R D Tax Credits Are You Missing Out Wipfli

R D Tax Credit Explained See If You Qualify Engineered Tax Services

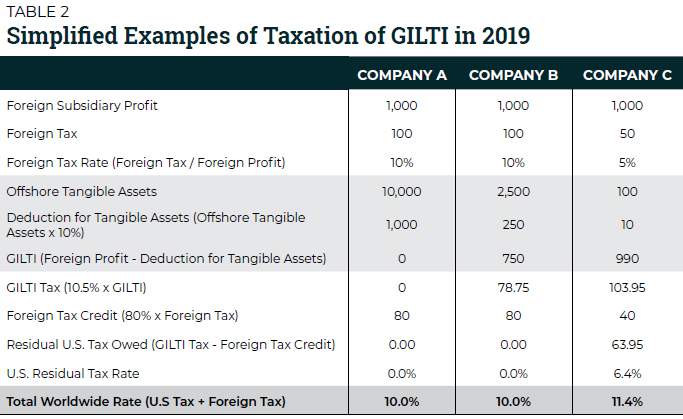

Understanding And Fixing The New International Corporate Tax System Itep

R D Tax Credit Explained See If You Qualify Engineered Tax Services

R D Tax Credit Explained See If You Qualify Engineered Tax Services

Rdec Scheme R D Expenditure Credit Explained

R D Tax Credit Calculation Methods Adp

R D Tax Credit Rates For Rdec Scheme Forrestbrown

R D Tax Trends What To Watch For In 2022 Global Tax Management